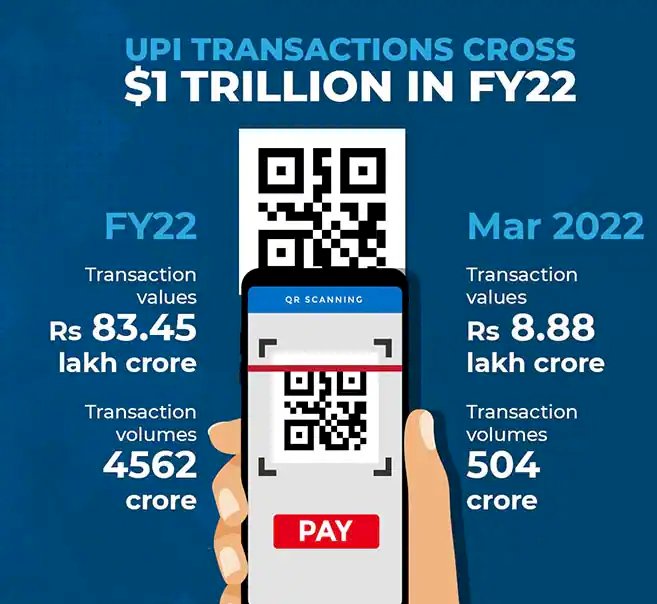

In FY22, UPI achieves a watershed point, with digital transaction value surpassing $1 trillion.

In March, the payments system's volume passed the 500-crore threshold for the first time. UPI accounted for 60% of India's retail payment volumes in FY22.

The Unified Payments Interface (UPI) has surpassed the $1 trillion mark in transaction values for the fiscal year 2021-22, marking a significant milestone for the payments system, which has seen significant growth over the last two years and led to increased digital adoption of payments and financial services.

UPI transactions totaled Rs 83.45 lakh crore in FY22, according to data from the National Payments Corporation of India (NPCI), which handles and manages UPI payments. $1 trillion equals approximately Rs 75.82 lakh crore at the current exchange rate.

In March, the payments system's volume passed the 500-crore threshold for the first time. According to the National Payments Corporation of India (NPCI), 504 crore transactions had been logged by March 29.

In terms of transaction values for the month, UPI recorded Rs 8.88 lakh crore in transactions as of March 29, up 7.5 percent from February.

Due to the epidemic and the consequent broad acceptance of digital payments in India, UPI has seen a considerable increase in transactions over the last two years. In the last two years, the payments mode has shattered numerous records and is presently approaching Rs 9 lakh crore in monthly transaction values.

UPI has over 260 crore transactions valued at Rs 4.93 lakh crore at the start of FY22, in April 2021. Monthly transaction volumes and values were up 94 percent and 80 percent, respectively, a year later.

The share of UPI in total retail payments in the country has been steadily increasing. UPI accounted for 60% of India's retail payment volumes in FY22. According to a Macquarie Securities analysis, it remains the favored means of payment for low-value transactions, accounting for only 16 percent of transaction values in FY22.

Around 50% of UPI transactions are for less than Rs 200, and 75% of all retail transactions in India (including cash) are worth less than Rs 100.

The Reserve Bank of India (RBI) authorized the National Payments Corporation of India (NPCI) to deploy UPI for feature phones as well as for small-value offline transactions to boost the use of digital means of payment.

On March 8, RBI Governor Shaktikanta Das launched UPI 123Pay for feature phones, which allows all transactions, except scan and pay, to be completed without the use of an internet connection. During the event, Das stated that UPI transactions are expected to surpass $1 trillion this fiscal year.

The NPCI disclosed its intentions for UPI Lite for small-value offline digital payments of up to Rs 200 in a circular to banks. It has devised an on-device wallet to do this, with a maximum amount of Rs 2,000 at any given time.

The transactions can also be completed without the use of a UPI PIN. Customers that use several UPI apps will be able to have numerous balances on their devices. At regular periods, users will receive consolidated debit SMS for financial transactions.

NPCI hopes to reach a run rate of one billion transactions per day in three to five years by expanding its reach beyond major cities and towns.

Lalita Singh

Lalita Singh