Empowering Startups: The SIDBI Fund of Funds Scheme (FFS)

Learn about the SIDBI Fund of Funds Scheme (FFS), a crucial part of the Startup India Action Plan aimed at providing financial support to startups through Alternative Investment Funds (AIFs). Discover the scheme's objectives, eligibility criteria, and impact on India's startup ecosystem.

The Small Industries Development Bank of India (SIDBI) plays a pivotal role in fostering entrepreneurship and innovation in India through its Fund of Funds Scheme (FFS). Launched as part of the Startup India Action Plan, the FFS aims to provide indirect funding to startups by contributing to various Alternative Investment Funds (AIFs) registered with the Securities and Exchange Board of India (SEBI).

Objectives of the Scheme

The primary objective of the FFS is to boost entrepreneurship by providing financial support to startups through AIFs. SIDBI contributes to the corpus of these funds, which in turn invest in startups, thereby creating a multiplier effect in the startup ecosystem.

Key Features of the Scheme

-

Corpus and Contributions: The FFS has an approved corpus of INR 10,000 crore. SIDBI contributes to the corpus of SEBI-registered Venture Funds or AIFs (Category I & II), which are required to invest at least twice the amount of SIDBI's contribution in startups.

-

Eligibility Criteria for Funds: Funds applying for contribution under the FFS must be registered as Category I or II AIFs with SEBI or have applied for the same. They should have a corpus of less than INR 1,000 crore and an investment strategy that includes startups.

-

Eligibility Criteria for Startups: Startups eligible for funding under the FFS must be incorporated or registered in India, not prior to seven years (ten years for biotechnology startups), and meet the definition of startups as per the Startup India, Standup India scheme.

-

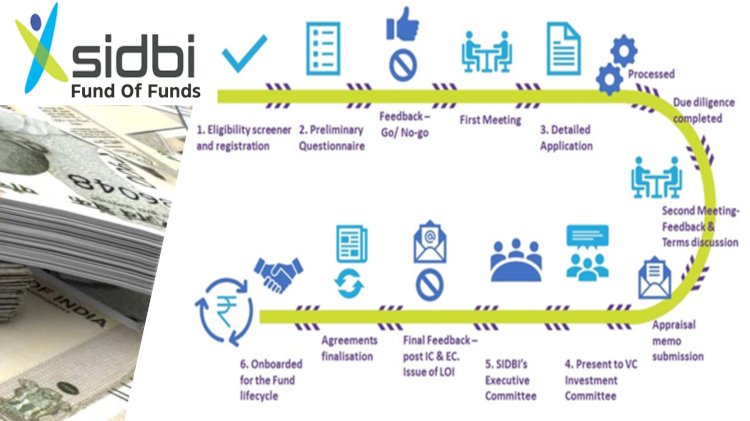

Application Process: The application process for funds to receive contributions under the FFS is conducted online. The Venture Capital Investment Committee (VCIC), comprising VC domain experts, evaluates the applications based on various criteria, including the fund manager's track record and the fund's investment strategy.

Impact and Achievements

Since its inception, the FFS has made significant strides in supporting the startup ecosystem. As of September 2024, SIDBI has sanctioned contributions amounting to INR 7,225.45 crore and disbursements of INR 2,492.24 crore. The scheme has supported numerous startups across various sectors, contributing to job creation and economic growth.

Conclusion

The SIDBI Fund of Funds Scheme is a cornerstone of the Startup India initiative, providing crucial financial support to startups and fostering a culture of innovation and entrepreneurship. By leveraging the expertise of AIFs, the scheme ensures that startups receive the necessary funding to grow and thrive, ultimately contributing to the nation's economic development.