How to Secure Investors for Your Startup in India

Learn how to secure investors for your startup in India with this step-by-step guide. Discover types of investors, tips for crafting a compelling pitch, and strategies for building relationships and visibility to attract funding.

Starting a business is an exciting journey that begins with a great idea. However, transforming that idea into a successful startup requires more than just creativity and hard work. It needs funding—and securing the right investors is crucial for taking your startup from concept to reality. In India, where the startup ecosystem is rapidly growing, finding investors can be a game-changer for your business. Here’s a comprehensive guide on how to secure investors for your startup in India.

- Understand the Types of Investors

Before you start looking for investors, it’s important to understand the different types of funding sources available. Each type of investor has unique characteristics and requirements, so it’s essential to know which one is the best fit for your startup.

Personal Investors

Personal investors are typically your family, friends, and acquaintances. They are usually the first people you approach for initial funding when your startup is in its early stages. These investors may provide the seed capital needed to cover initial expenses, such as product development and market research. The advantage of personal investors is that they are often more flexible and willing to take risks. However, this type of funding is usually limited, and as your business grows, you will need to explore other sources.

Angel Investors

Angel investors are high-net-worth individuals who invest their personal funds in startups in exchange for equity or convertible debt. They are often experienced entrepreneurs or professionals who are looking for promising business ideas to support. Angel investors can provide significant capital, and their involvement often goes beyond just financial support—they may offer valuable mentorship and networking opportunities. They are ideal for startups that are past the initial stage and are looking to scale.

Venture Capitalists (VCs)

Venture capitalists are firms or individuals that invest in startups with high growth potential in exchange for equity. Unlike angel investors, VCs typically provide larger sums of capital and are more focused on startups that have already gained some traction in the market. They tend to be more hands-on, offering strategic guidance, operational support, and industry connections. Venture capital is suitable for startups that require substantial funding to scale quickly and are ready for the challenges of rapid growth.

- Build a Strong Business Plan

A well-crafted business plan is essential for attracting investors. Your business plan should clearly outline your startup’s mission, vision, target market, revenue model, competitive landscape, and growth strategy. Investors want to see that you have a clear understanding of your business and the market you're entering.

Key elements to include in your business plan:

- Executive Summary: A brief overview of your startup, its goals, and the problem it solves.

- Market Research: Data on the market opportunity, target audience, and competitors.

- Revenue Model: How you plan to generate income and sustain growth.

- Financial Projections: Forecasts for revenue, expenses, and profitability over the next few years.

- Exit Strategy: How investors will eventually make a return on their investment, whether through acquisition, IPO, or other means.

A compelling business plan will help investors understand the potential of your startup and demonstrate that you have a clear path to success.

- Network and Build Relationships

Networking is one of the most effective ways to find investors. Attend startup events, pitch competitions, and industry conferences where investors are likely to be present. Building relationships with investors takes time, so it’s essential to start early and stay engaged.

Here are some ways to network with potential investors:

- Join Startup Incubators and Accelerators: Many incubators and accelerators offer mentorship and access to a network of investors. They can help you refine your business model and pitch, making it easier to attract funding.

- Attend Investor Meetups: Look for investor-focused events in your city. These meetups provide a platform for startups to pitch their ideas to a group of investors.

- Leverage Social Media: Platforms like LinkedIn and Twitter are great for connecting with investors. Share updates about your startup, engage with investor posts, and build your online presence.

- Seek Referrals: If you know someone who has already secured funding, ask them for introductions to investors in their network.

The more you network and engage with potential investors, the higher your chances of finding the right match for your startup.

- Craft a Compelling Pitch

Once you’ve identified potential investors, the next step is to pitch your startup. Your pitch should be clear, concise, and engaging. Investors receive numerous pitches, so you need to make yours stand out.

Here’s how to craft a compelling pitch:

- Start with the Problem: Clearly define the problem your startup is solving. Investors want to know that your business addresses a real pain point in the market.

- Present Your Solution: Explain how your product or service solves the problem. Highlight what makes your solution unique and why it has the potential to succeed.

- Show Traction: If you’ve already gained customers, secured partnerships, or achieved significant milestones, be sure to highlight these achievements. This shows that your startup is gaining momentum.

- Explain the Market Opportunity: Provide data on the market size, growth potential, and customer demand. Investors want to know that your startup has room to grow.

- Outline Your Financial Needs: Be specific about how much funding you need and how you plan to use it. Break down your financial requirements and explain how the investment will help you achieve your goals.

- End with a Strong Closing: Leave investors with a lasting impression. Summarize your key points and invite them to ask questions or schedule a follow-up meeting.

- Leverage Online Platforms

In addition to traditional networking and pitching, you can also explore online platforms that connect startups with investors. Some popular platforms in India include:

- AngelList: A global platform that connects startups with angel investors and venture capitalists.

- LetsVenture: A platform that helps startups raise funds from angel investors and VCs.

- Fundable: A crowdfunding platform that allows startups to raise capital from a large number of investors.

- SeedInvest: An equity crowdfunding platform that allows startups to raise funds from accredited investors.

These platforms provide a convenient way to connect with investors and raise capital without the need for in-person meetings.

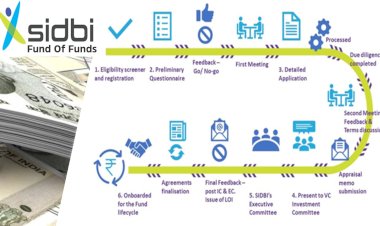

- Be Prepared for Due Diligence

Once you’ve piqued an investor’s interest, they will conduct due diligence to assess the viability of your startup. This process involves reviewing your financials, business operations, market potential, and legal structure. Be prepared to provide detailed information about your startup, including:

- Financial Statements: Profit and loss statements, balance sheets, and cash flow projections.

- Legal Documents: Business registration, intellectual property rights, and contracts.

- Team Backgrounds: Information about the key members of your team, their qualifications, and experience.

A thorough and transparent due diligence process will help build trust with potential investors and increase your chances of securing funding.

- Negotiate Terms and Close the Deal

Once you’ve secured an investor, the final step is negotiating the terms of the investment. This includes the amount of equity you’re willing to give up, the valuation of your startup, and any other conditions the investor may have. It’s important to work with a lawyer or financial advisor to ensure that the terms are fair and aligned with your long-term goals.

Once the terms are agreed upon, the deal is closed, and you can begin using the funds to grow your startup.

Conclusion

Securing investors for your startup in India requires a combination of strategy, networking, and preparation. By understanding the different types of investors, building a solid business plan, and crafting a compelling pitch, you can increase your chances of attracting the right investors who will help take your startup to the next level. Remember, finding the right investor is not just about securing funding—it’s about finding a partner who believes in your vision and can help you achieve your goals.