The Zerodha Model of profitability - How sustainability and profitability can coexist in business

This is the story of Zerodha, a rare profitable unicorn in India and the lessons early stage startups can learn from Nithin Kamath and team about how to make a startup profitable and remain bootstrapped in the process.

Traits that made Zerodha, a money-spinning unicorn everyone is talking about!

When the country was celerating 64th Independence day in the year 2010, the Kamath brothers in Karnataka kicked off the operations for something substantial to break all barriers that traders and investors faced in India back then in terms of cost, support, and technology, especially when the market witnessed one of the biggest financial crisis in 2008 and 2009. At the time when most of the startups worldwide are struggling to reach profitability, here is Zerodha, topping the chart of profitable unicorns in India. Let's understand how they do it.

What number did Zerodha post in FY22? What was their Profit Margin and Operational Revenue?

India’s largest stock broking platform Zerodha has recorded an operational revenue of ₹4,964 crore in FY22 which is almost 82 per cent growth over the ₹2,729 crore revenue recorded in FY21, according to the company’s recent MCA filings. Further, the company reported a profit of ₹2,094 crore in FY 22, which is 86 per cent higher than the company’s ₹1,122 crore profit in FY21.

Where does their money come from?

Zerodha’s revenue streams include the sale of tech products like Kite Connect API, exchange transaction fees, collections from user onboarding and brokerage fees.

Where do they spend most of their operating revenue?

In FY22, the company’s expenses also grew by 72% to ₹2,164.1 crore, as compared to ₹1,260.2 crore in FY21. Its employee benefit expense grew 45% to ₹459 crore. A large part of this was other expenses that grew 82% to ₹1,686.5 crore during the year, which included an information technology expense of ₹303.1 crore and miscellaneous expenses of ₹1,342.4 crore.

How did their competitors performed in FY22?

Zerodha competes with unicorns like Upstox and Groww, two heavily funded companies, sitting on a valuation of more than $3 billion each. However, Groww reported a much smaller operating revenue in FY22 of as much as Rs 351 crore with a loss of 239 Crores while Upstox's revenue from operations grew 77.4% to Rs 765.6 crore in FY22 from Rs 431.46 crore in FY21 and Upstox's losses skyrocketed 6X to Rs 444.57 crore in FY22 from Rs 71.67 crore in FY21.

What is the revenue model of Zerodha?

Zerodha works on the principle of the “Low Margin and High-Volume Model”. The company charges only Rs. 20, or 0.03% brokerage, which is lower than all other broking firms, for every F & O and other intraday equity trade. The company charges only Rs. 300 annually in the name of account maintenance. With this concept, the company saw a rapid increase in its user base, which contributed 2% to the revenue of Zerodha.

Why and How did Zerodha post such strong profit numbers consistenty?

Though there are many factors why Zerodha is a rare profitable unicorn in India, here I would share the Five most prominent picks –

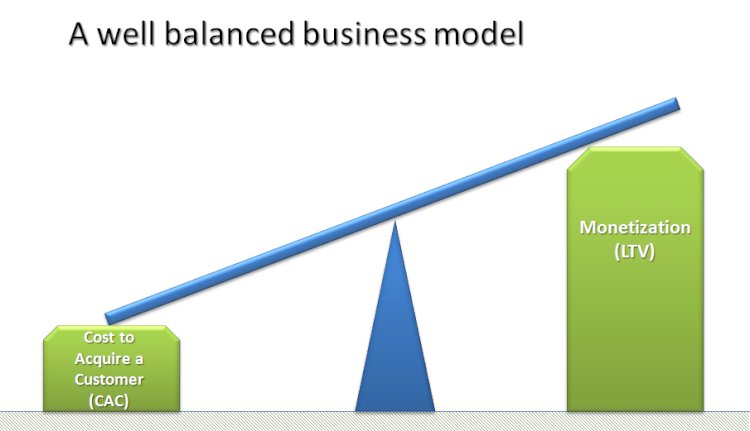

- Zero Customer Acquisition Cost (CAC) - The challenge with most of the startups is that while millions of users can be acquired by spending, the audience that can generate revenue to cover the customer acquisition cost (CAS) is relatively very small. In this age where startups often spend 2 to 3X acquiring customers to generate the revenue of X, here is Zerodha with Zero CAC, instead they run a referral and partner program where they don't have to pay upfront charges and only share a fixed % of revenue generated in future.

- Sustainable and Futuristic Technology Base - To stay competitive, the firm launched many tech products that are very versatile including -

- KITE - Trading and investment platform using latest technology, thereby providing ease to the customer to trade and transact

- Console - Providing in-depth reports and visualizations for getting more insightful ideas

- KITE connect APIs - For building innovative trading and investment platform

- Z Connect - Publish articles and blogs related to the stock market, trading, and investments.

- COIN - Commission-free purchase of mutual funds which will be directly delivered in the demat account of the customer.

- RAIN MATTER - Incubates funding as well as mentorship to startup companies, as well as by giving a minority stake in the exchange.

The firm has ever since been growing based on the principle of Technology first by bringing valuable services to the customers. Interestingly, the firm has spent little on marketing and the growth has been riding on the back of customer satisfaction and Techonlogy.

- Early Marketing Strategy, Word-of-Mouth – As Nithin Kamath once said “people don't really get interested in trading or start investing by coming across ads about investing”. Most likely, investors get interested in trading after having a conversation with a friend or a reliable/respected acquaintance or mentor. So, all marketing would've to be through Word-of-Mouth. It mainly had 2 ways of marketing their startup: Community Outreach and Offline Telemarketing

- Did not try to reinvent the wheel - Zerodha was not the world's first-ever discount brokerage company; it was the Charles Schwab Corporation in 1975 in the US, a discount brokerage model which significantly reduces the commission charged for transactions, enabling the masses to invest. Zerodha used this already successful solution and customised it to the Indian markets, addressing the pain points of the existing services, and providing an attractive option to investors.

- Outreach Strategy for non-customers - Moving everything online reduced the costs of offline branches. It increased the speed of trading and executions using technology. It eliminated or reduced the fees charged to the investors. It started different financial literacy programs like 'Varsity' and 'TradinQnA'—a forum for traders to ask questions. This resulted into Zerodha getting more of non-customers who remained unserved until then.

So what are the lessons here for an early stage startup from Nithin Kamath and Zerodha?

In this digital age, almost every startup is eyeing to raise some quick funds and get to the unicorn status. On a contrary, a profitable startup Zerodha offers an exemplary journey as a bootstrap company. A couple of things that helped Zerodha achieve scale included not spending on advertising, which is one of the biggest costs for most businesses; hiring and retaining the right people; and being extremely nimble. Misjudging the market size and opportunity, then setting wrong expectations and chasing valuations are probably the biggest reason why startups fail, believes Zerodha's founder. Sustainability for Zerodha is more important than valuation and not every business is VC'able or can be valued at $10 million, $100 million, or $1 billion.