How Technology is Changing Angel Investing

IM Angel Funds is leveraging technology to revolutionize angel investing, enabling smarter, quicker, and more informed decisions. Data-driven decision-making and Enterprise Resource Planning (ERP) tools are essential for evaluating potential investments and monitoring performance. As technology continues to evolve, IM Angel Funds is committed to staying ahead of the curve and providing investors with the best opportunities.

In the fast-paced world of angel investing, staying ahead of the curve is not just an advantage—it's a necessity. As a team dedicated to fostering innovation through strategic investments, IM Angel Funds recognizes the transformative power of technology in reshaping the landscape of angel investing. From leveraging data analytics to utilizing ERP tools, technology is enabling investors to make smarter, quicker, and more informed decisions.

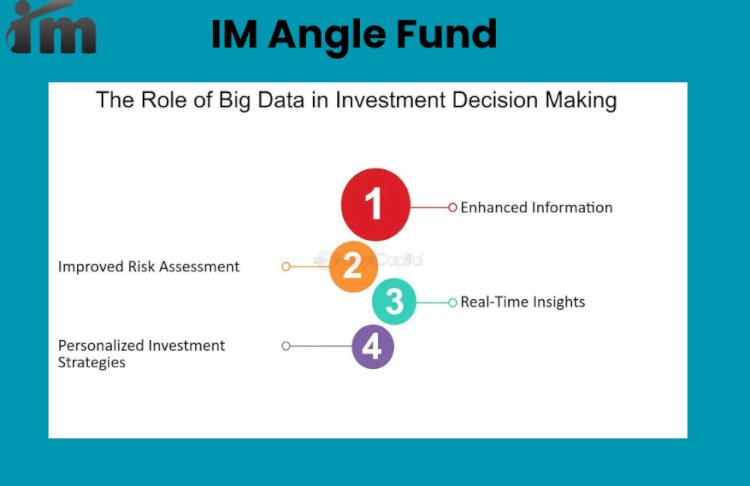

The Rise of Data-Driven Decision Making

Gone are the days when angel investors relied solely on gut feelings and personal connections to make investment decisions. Today, technology provides a wealth of data that can be analyzed to uncover trends, assess risks, and identify promising startups. At IM Angel Funds, we have embraced this shift towards data-driven decision-making, utilizing advanced analytics to evaluate potential investments and monitor the performance of our portfolio companies.

The Role of ERP Tools in Angel Investing

One of the most significant technological advancements impacting angel investing is the integration of Enterprise Resource Planning (ERP) tools. These tools are no longer just for large corporations; they have become essential for startups and investors alike. ERP tools provide a centralized platform for managing financial data, operations, and customer relationships, offering a comprehensive view of a startup's health and growth potential.

For angel investors, ERP tools are invaluable in streamlining the due diligence process. With real-time access to key financial metrics, investors can make quick, data-based decisions, reducing the time it takes to move from evaluation to investment. Furthermore, ERP tools help in tracking the progress of investments, allowing investors to monitor performance and identify any red flags early on.

Enhancing Collaboration and Transparency

Technology has also enhanced collaboration and transparency between investors and startups. Cloud-based platforms allow for seamless communication and document sharing, making it easier for investors to stay updated on a startup's progress. This increased transparency fosters trust and ensures that both parties are aligned on goals and expectations.

Looking Ahead: The Future of Angel Investing

As technology continues to evolve, so too will the landscape of angel investing. Artificial intelligence, blockchain, and machine learning are poised to play significant roles in the future, offering even more tools for investors to leverage. At IM Angel Funds, we are committed to staying at the forefront of these developments, ensuring that we continue to provide our investors with the best possible opportunities.

Conclusion

Technology is not just changing how we invest—it's revolutionizing the entire process. By embracing the latest technological advancements, IM Angel Funds is able to offer investors a more efficient, data-driven, and transparent investment experience. As the world of angel investing continues to evolve, we remain dedicated to leveraging technology to make smarter investments and drive innovation forward.