What different "corns" exist in the startup world?

"Living the life of your dreams is the biggest adventure you can go on."

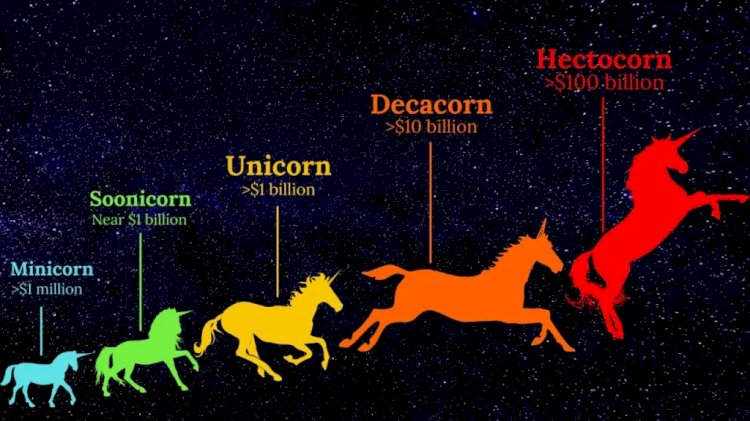

Every startup hopes to one day achieve success and reach its pinnacle. Most startups start out small, and only a select few overcome all obstacles to become the best and change the world in some way by offering something useful to society. A start-up must pass a number of hurdles before earning the badges of honor known as the Minicorn, Unicorn, Decacorn, and Hectocorn.

The startup industry is rife with jargon and buzzwords that have crept into our everyday speech. "Unicorn" is one such word that has become more popular recently. A startup that has a value of over $1 billion is called a unicorn.

But did you know that the world is also home to other "corns"? Let's explore the various startup niches!

What exactly is a startup?

Let's first define what a startup is before we drill down into the various startup "corns." A startup is a business in its early stages of development that is typically started by one or more entrepreneurs with the intention of creating a special product or service that addresses a market need. Venture capitalists or angel investors who think a startup has the potential to succeed frequently fund it.

The startup world has different corns.

Minicorn

Minicorns, which fall within the $100 million to $1 billion valuation range, occupy a special place in the startup world. They have already established themselves as valuable assets and have grown in popularity in their specialized markets, but they are still not at the level of unicorns, which are valued at $1 billion or more.

Anand Sanwal, the founder and CEO of the market research company CB Insights, coined the term "minicorn" first. The phrase was created by Sanwal to describe businesses that had experienced rapid growth and were close to becoming unicorns but had not yet achieved that milestone.

Minicorns may not receive as much hype or media coverage as unicorns, but they are still very valuable businesses with great growth potential. They have already attracted significant investment, gained traction in the market, and demonstrated the viability of their business model. As a result, they are frequently regarded as being less risky than startups in an earlier stage, and they can therefore make appealing investments for venture capitalists and other investors.

SooniCorn

A startup is considered a soonicorn if its valuation is already between $500 million and $1 billion and it is anticipated that it will soon surpass the $1 billion unicorn threshold. As they have already accumulated a sizable market share and are anticipated to experience exponential growth, they are frequently regarded as the next big thing in the startup world.

Soonicorns are frequently in a high-growth stage, with a rapidly growing customer base and a successful business model. They may already have received a sizeable amount of funding from venture capitalists and other investors, and they are in a good position to do so as they grow. Venture capitalists and other investors frequently view soonicorns as appealing investments due to their high growth potential and high likelihood of developing into unicorns in the near future. They are also viewed as being riskier than mature unicorns because they might still experience intense competition or other difficulties as they develop.

Unicorn

Businesses valued at $1 billion or more are considered unicorns. Since the term was first used in 2013, there have been a lot more unicorns, and they have come to represent success and innovation in the startup community.

Unicorns frequently operate in high-growth sectors like technology, e-commerce, or healthcare, and their distinctive business models enable them to grow quickly. They are frequently regarded as some of the most valuable and innovative businesses in the world, and they may have already received sizeable funding from venture capitalists and other investors.

Because they have a high potential for growth and a high probability of producing sizeable returns, unicorns are frequently viewed as attractive investments by venture capitalists and other investors. They can be risky, though, as they might run into serious opposition or other difficulties as they scale and grow.

Decacorn

Businesses known as "decacorns" have been valued at $10 billion or more, putting them in a select group of highly valued startups. Even more uncommon than unicorns, decacorns frequently stand in for some of the most prosperous and cutting-edge businesses worldwide.

Decacorns frequently exhibit a high level of innovation and disruption, and they have the potential to fundamentally alter the markets in which they compete. Venture capitalists and other investors are also very interested in them because they view them as a unique and valuable opportunity to invest in a highly promising startup.

Decacorns may be very successful, but they also come under close scrutiny and encounter many difficulties as they expand and scale. They might experience heightened competition, difficult regulatory conditions, or other dangers that could jeopardize their success.

Hectocorn

Startups that have attained a mind-boggling valuation of $100 billion or more are referred to as hectocorns. There are only a few of these businesses in the entire world, making them even rarer than decacorns.

It is uncommon to invest in a hectocorn because so few businesses have attained this level of valuation. Due to their well-established reputation, substantial financial resources, and successful track record, they are regarded as a relatively safe investment; however, they are still subject to the same risks and difficulties that all businesses face. They additionally encounter particular difficulties like regulatory vigilance and antitrust issues.

Lalita Singh

Lalita Singh